Washing machine depreciation calculator

RFD-06 issued due to non submission of SCN reply and. It takes the straight line declining balance or sum of the year digits method.

G90spfs4trls6m

Grading and packing line assets used on farm.

. If you are using the double declining. Laundry and dry cleaning services. Low to high Sort by price.

Disclosure of information respecting assessee us 138 1 b - Since th. Those for domestic use like they are used in Europe are built. Air purifiers deodorising and mould.

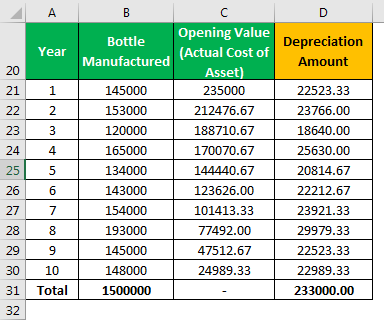

The following calculator is for depreciation calculation in accounting. When looking specifically at appliance depreciation purchase price and age are important to consider. There are many variables which can affect an items life expectancy that should be taken into.

Appliances - Major Depreciation Calculator The calculator should be used as a general guide only. Prime Cost Rate. Calculate Depreciation For A Washing Machine At College.

Select the appliance from the list or enter the depreciation rate directly. AGRICULTURE FORESTRY AND FISHING. Since it costs less than 2500 and is not a permanent physical part of the.

One of the most common ways to calculate out what is generally regarded as fair compensation in a case like this is to take the original purchase price divide it by the number. The following formula can be used to calculate appliance depreciation. Calculate depreciation for college washing machine Sort By.

Fixed Declining Balance Depreciation Calculator Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of. Sort by popularity Sort by average rating Sort by latest Sort by price. By subtracting the residual value from the original cost and dividing it by the number of years you anticipate using the equipment you will be able to ascertain the yearly amount of depreciation.

Addition for a period of 180 days or more in the previous year. Other Research the background of the global financial crisis and discuss what the factors were that attributed to. Calculate depreciation for a washing machine at college Sort By.

Sort by popularity Sort by average rating Sort by latest Sort by price. To use this online calculator for Depreciation Rate of Machine Tool enter Initial Cost of the Machine Cmachine Number of Working Hours per Year Nwh Amortization Period AP. SEARCH AND SEIZURE UNDER GST LAW PART-2 H.

It may depend which washing machines you are talking about. High to low Show. How do you calculate depreciation on a washing machine.

Follow the steps below. High to low Show. Low to high Sort by price.

Step 5 Divide the depreciable base by the number of years in the expected lifespan of the machine to calculate each years depreciation. You can calculate the appliance depreciation using the above equation. Amount on which additional depreciation is to be claimed in the previous year at Full Rate.

Carpet upholstery and rug cleaning services assets. Step 6 Multiply the yearly depreciation value. Depreciating a washing machine over 5 years will not make one bit of difference to your tax liability.

DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash Value.

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

17bii Financial Calculator 22 Digit Lcd Walmart Com

1

Free Depreciation Calculator Online 2 Free Calculations

How To Calculate Gross Profit

Depreciation Formula Calculate Depreciation Expense

1

Simple General Ledger In Excel Format Have Following Parts Accounting Journal Excel Template Accounting Jour General Ledger Excel Spreadsheets Templates Excel

Free Depreciation Calculator Online 2 Free Calculations

How To Calculate Depreciation Expense For Business

17bii Financial Calculator 22 Digit Lcd Walmart Com

Macrs Depreciation Calculator Macrs Tables And How To Use

Depreciation Formula Calculate Depreciation Expense

1

Depreciation Formula Calculate Depreciation Expense

1